We invest in early-stage companies with strong teams and innovative technologies that have the potential to create positive impact at scale.

Key focus areas

Health Tech

Companies focused on improving learning outcomes and the educational experience for students through innovative pedagogy, assessment, and tools.

Climate Tech

Companies that accelerate climate transition through mobility, carbon markets, supply chain, energy and storage, data & services, and finance.

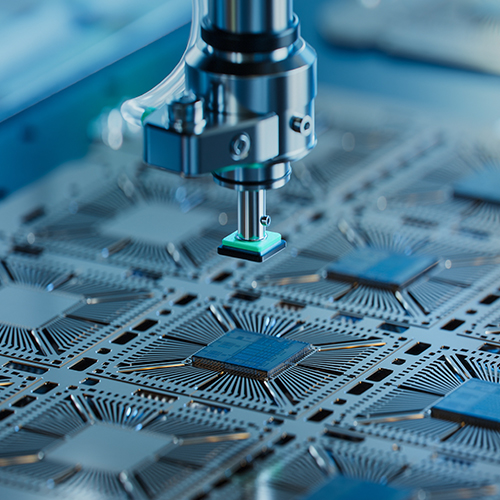

Deep Tech

Companies solving hard problems through transformational technologies using methods such as AI, quantum computing, and advanced manufacturing.

Consumer

Technology-enabled brands and services with strong moats that transform consumer experiences.

What we look for?

We invest in early-stage companies with bold ideas, differentiated technology, or unique, scalable business models that show early signs of product-market fit. Beyond numbers, we value strong team dynamics, passion, and a deep understanding of market stakeholders. Transparency and open communication are the cornerstones of our partnership approach, fostering trust and long-term collaboration with founders.

Investment Process

- Company founders fill in the pitch form or write to us at info@aureolis.co.in.

- Initial qualification by the Aureolis deal flow team: this step may involve email exchanges, or a phone call / video chat / in-person meeting depending on the nature of the opportunity.

- Pitch meeting: The company is invited to present the pitch and engage in deep dive discussion with our investment committee.

- Due diligence: Aureolis team will conduct due diligence process or work with other investors to complete due diligence as required.

- Final closing: We work with founder-friendly term sheets which have standard terms and rights.

- Unless the company objects (such as wishing to remain in stealth mode), the company logo is listed on the Aureolis website.

Think you are a fit?

Pitch to us